The Pros and Cons of Purchasing Presale Homes

The world of real estate is constantly evolving, and "presales" are typically one of the first real estate purchases for first time home buyers and investors alike. However, understanding the pros and cons of purchasing presale homes is paramount in order to make a sound real estate investment.

What is a Presale?

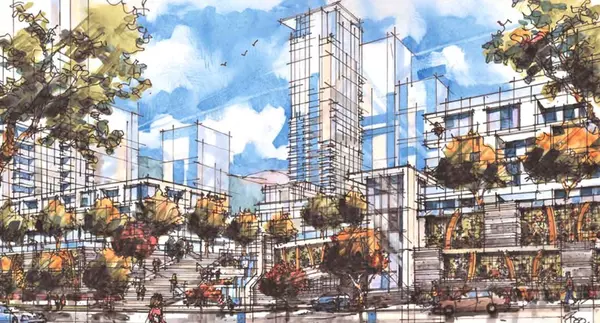

Presales – also known as off-plan or pre-construction homes, are a type of real estate investment where buyers can secure a property directly from a developer, typically before construction has started and sometimes with alluring incentives. While most presale homes are condominium units, there are also situations where townhouses, duplexes, multi-family or single-family houses are pre-sold as well.

However, since presale properties are not tangible assets, buyers are essentially purchasing a contract from the developer, with a promise to close on the property upon its completion.

What is most notable about presale investments is that buyers are securing a home with today’s current market rates, while the home is being built in the future, making it a potentially lucrative investment as the property will hopefully increase in value over the development term.

Presale homes typically have longer completion and possession timelines compared to the resale market. Condominiums may involve build times which range from 3 to 8 years, contingent on factors such as the nature of the development and the specific phase at which the buyer is making the purchase. For townhouses or single-family houses, on the other hand, commonly come with completion waiting periods of 2 to 3 years.

Pros of Buying a Presale Home:

1) The Potential for Home Appreciation:

One of the most enticing aspects of purchasing a presale home or investment is the potential for property appreciation or building equity. By securing a property at today's market rate during the presale phase, buyers not only lock in a favourable price but also position themselves to benefit from potential increases in home values over the 3-5+ year building timeline. The hope is that, upon completion, the property's market value will have appreciated, providing buyers with a promising return on investment (ROI). This anticipation of future value is a key factor driving the popularity of presales in real estate.

2) No Mortgage for a Number of Years:

One of the biggest incentives with purchasing a presale is the simple fact that you do not need a mortgage until the building completes. This could mean that for several years there is no mortgage, allowing the buyer to continue to save for an additional down payment and various closing costs.

* Realtor Tip - it is highly suggested to get pre-approved for a mortgage prior to purchasing a presale property, as certain large financial institutions such as RBC will allow interest rate holds, allowing you to secure an interest rate while you wait for the presale to be built. If rates go up over the course of the development build, the buyer has secured their investment by locking in a lower, more affordable interest rate.

3) Brand New Home:

Investing in a presale property offers the unique advantage of acquiring a brand-new home that has never been lived in. This pristine condition provides buyers with a fresh start, free from the possible wear and tear that often accompanies pre-owned residences. The allure of a new home extends beyond its untouched state, it means completely new and modern designs, the latest construction materials, and cutting-edge technology. This advantage not only caters to a desire for contemporary living but also eliminates potential renovation costs and the need for immediate repairs, offering a seamless and enjoyable transition into a pristine, new home.

4) Opportunity to Select Materials and Make Customizations:

When purchasing a presale, buyers often have the opportunity to customize different aspects of their property, such as colour schemes, finishes, layout, and sometimes even floorplans. This gives buyers the ability to tailor their future home according to their preferences.

The extent of customization available varies between developers, however in a highly competitive market, developers that offer add-ons, such as the option to purchase additional parking spaces, storage lockers, and opt-in for upgraded home systems or specific fixtures gives their presale development a competitive edge.

These additional features not only enhance the living experience for the buyer but can also make the property more attractive to future buyers or potential renters.

* Realtor Tip - It is always advisable to go with selecting a neutral colour scheme, especially if the purpose of the presale is to assign or flip the property.

5) Lower Initial Costs Than Resale Market:

Investing in presales has a lower initial cost when compared to the resale market. Presale buyers typically pay a deposit, which is a fraction of the full purchase price ranging from 5-20%, making it a more financially accessible option. This lower upfront cost is primarily because presales involve an intangible product — essentially, buyers are investing in a concept and a contract rather than a finished property that’s ready to move in.

This "set it and forget it" approach allows buyers to secure their future home at a reduced upfront investment in today’s market, and then wait a few years for the building to complete, providing a more manageable entry point into the real estate market. This is especially beneficial for First Time Home Buyers looking to make their initial move into property ownership.

6) The BC New Home Warranty - 2-5-10 Warranty:

When purchasing a presale home in British Columbia, buyers benefit from the comprehensive BC New Home Warranty, a mandatory insurance program designed to protect new homeowners from potential construction defects in their newly built properties. Managed by the BC government, this program is overseen by third-party warranty providers, ensuring adherence to the highest construction and design standards outlined in the Home Owner Protection Act.

The warranty program covers different aspects over varying periods in the 2-5-10 New Home Warranty:

2 Years on Labour and Materials:

- 12 months of coverage for construction defects, encompassing materials and labor, in detached homes and non-common property in strata units.

- 15 months for the common property of strata buildings.

- 24 months for specific defects in all new buildings, including issues with delivery systems, exterior components, and more.

5 Years on the Building Envelope:

- Focused on protection against external threats, particularly unintended water penetration

10 Years on the Building Structure:

- Provides long-term assurance that the primary structural elements of the home are free from defects.

Another feature of the 2-5-10 New Home Warranty is its transferability, which is linked to the home rather than the owner. Even if the property changes hands, the warranty remains intact until it expires.

7) 7 Day Buyers Rescission Period:

According to REDMA (Real Estate Development Marketing Act) which governs developers in BC, they must offer all presale buyers a 7-day Rescission Period after an accepted contract is signed, which allows the buyer to go over the disclosure statement and decide if this presale development project is in fact the correct one for their own personal needs. After the 7 day period, the contract then becomes binding.

Cons of Buying a Presale Home:

1) Presales are an Intangible Product:

One downside of presale investments is their intangible nature. Purchasing from a floor plan or showroom model means buyers don't physically see the finished product before committing to a purchase. While developers offer detailed representations, the absence of a tangible property for inspection may deter potential investors or first-time home buyers who may prefer a more concrete understanding of their prospective home.

Relying on floor plans and showrooms entails a degree of imagination, and while developers often provide detailed representations, the absence of a physical structure to inspect can be a source of concern for those who value a firsthand look at their prospective home.

2) Real Estate Market Flucuations and Risks:

Real estate markets can be unpredictable, and therefore property values may not always appreciate as expected. These economic downturns or market corrections can impact the potential for investment gains and regardless of the market conditions, when the development is completed, the buyer will have to complete on the property. If at the time of completion the market is in a downturn and selling is not optimal, you can hold the property as a rental or potentially move in and make it your primary residence.

3) Possible Additional Federal Taxes:

Buyers of presale properties should be mindful of the possible additional finances required, such as the the 5% Goods and Services Tax (GST) on newly constructed homes. This tax is applicable on the purchase price of the presale unit selected by the buyer, and it’s crucial to note that the GST payment is due upon the completion of the project.

In the case where a buyer assigns their presale contract to a new buyer, it's important to be aware that the responsibility for paying the 5% GST would then shift to the new buyer. This adds another layer of financial consideration for those engaging in presale transactions, emphasizing the need for thorough understanding and planning.

4) Construction Delays:

Delays in construction are commonplace in real estate developments. There could be a variety of reasons that a project gets delayed, such as building permits from the city, higher costs for construction materials, labour shortages, inadequate sales of the presale development and more.

This is why working with a professional real estate agent is essential when purchasing a presale unit from a reputable developer, to not only ensure that you will receive a quality finished product, but also that they are able to follow through and resolve potential delays swiftly.

5) Changes in Floorplans and Finishes:

In the Contract of Purchase and Sale (CPS) and Disclosure Statement that is provided to buyers, developers retain the right to introduce slight variances to the project's design, features, amenities, and floorplans of the building. This means that the finished product may have slight deviations from the initial expectations. However, developers are required to substitute such finishes and designs to an equal or greater substitute compared to the original product.

Buyers need to be mindful of these potential changes and carefully assess whether the adjusted features align with their preferences and investment goals.

*Realtor Tip - By working with a realtor and letting them represent you in purchasing a presale, they can assist buyers in understanding the variance allowances are allowed by the developer.

6) Tying Up Capital from Presale Deposits:

Investing in a presale property requires a single or multiple deposits over a specified period of time, depending on the developer and their requirements for the project. This ties up a large chunk of capital that could potentially be used for other investments or opportunities, making it a significant financial commitment.

On average, presale deposits can range anywhere from 10%-20% of the total presale property value. Each presale is unique and the developer will decide the deposit percentage and payment structure and they have the ability to change these at any time.

7) Buyer’s Job Security:

As a buyer, having job security is a critical consideration in the presale purchase journey, particularly at the completion of the project when it’s time to secure a mortgage. Banks and other financial institutions require proof of consistent, so a buyer’s ability to meet mortgage obligations hinges on a consistent income stream.

The need for financial stability over the extended period until property completion adds an additional layer of importance to maintaining job security throughout the presale transaction.

8) Developer Rejecting Assignment of Presale Contract

Real estate investors often follow a specific strategy in the presale market by initially purchasing a presale and later ‘assigning the contract’ to another buyer typically during the construction or at its final build stages. By doing this, the investor avoids paying Property Transfer Tax (PTT) as it is passed onto the new buyer and also potentially gains a ‘lift’ — which is the difference between the presale purchase price and the actual sold price.

However, if the developer decides to reject the assignment request, the investor is required to proceed with closing on the presale home and securing a mortgage. This unexpected turn can impact the assignment strategy, but thankfully there are several other ways to proceed if this happens.

9) Purchasing Off a Floor Plan and Presentation Center Mock Ups

Since the presale is not yet constructed, buyers are presented with representations through floor plans, 3D models, and presentation center mock-ups. This demands a level of creativity and imagination from the buyer to envision the final product.

While some find the process exciting, it may not be everyone's preferred mode of purchasing a home. Some buyers prefer the tangible experience of touring a completed home, feeling the spaces, and seeing the finished product before making such a substantial investment. The presale approach requires a level of comfort with visualizing a home that is yet to materialize, making it a choice that might not align with everyone's preferences.

10) Project Cancellation:

One rare but substantial risk associated with presales is the potential for project cancellation. This outcome hinges on various factors, including zoning and approval challenges, economic viability concerns, difficulties in securing project financing, or even the developer facing bankruptcy. While project cancellations are very infrequent, buyers need to be aware of these possibilities, conduct their own due diligence on the developer, and market conditions before entering into a presale agreement. This is why working with a professional real estate agent can ensure you understand all possible outcomes to your real estate investment.

Final Thoughts on Purchasing Presale Homes:

Presale investments can be a valuable addition to not only a first time home buyer who is interested in entering the real estate market, but also to seasoned investors looking to diversify their real estate portfolio.

Presales offer the potential for appreciation and customization, however with any investment, there are risks involved such as market fluctuations and construction delays, which could impact the investment's success overall.

Ultimately, whether presale investments are 'worth it' depends on a buyers risk tolerance, investment goals and weighing the pros and cons of this investment type. It's important to do your own due diligence, work with a knowledgeable real estate agent, and carefully review presale contracts before deciding if investment type aligns with your financial objectives.

If you are interested in purchasing your own presale property, or want to learn more information on different projects and developers, please feel free to get in touch with me directly at 778-798-0656 or via email: info@listwithamanda.com

Categories

Recent Posts

LOOKING TO BUY, SELL OR INVEST IN REAL ESTATE?